ARTICLE AD BOX

House Republicans are edging ever closer to getting President Donald Trump’s “big, beautiful bill” over the line by winning over GOP holdouts.

Lawmakers in the House Republican caucus have been bickering over the fate of their budget reconciliation package as Speaker Mike Johnson said he wanted a final vote to take place Wednesday.

“President Trump’s ‘one, big, beautiful bill’ is going to require one big, beautiful vote,” Johnson said. “We are going to get this done.”

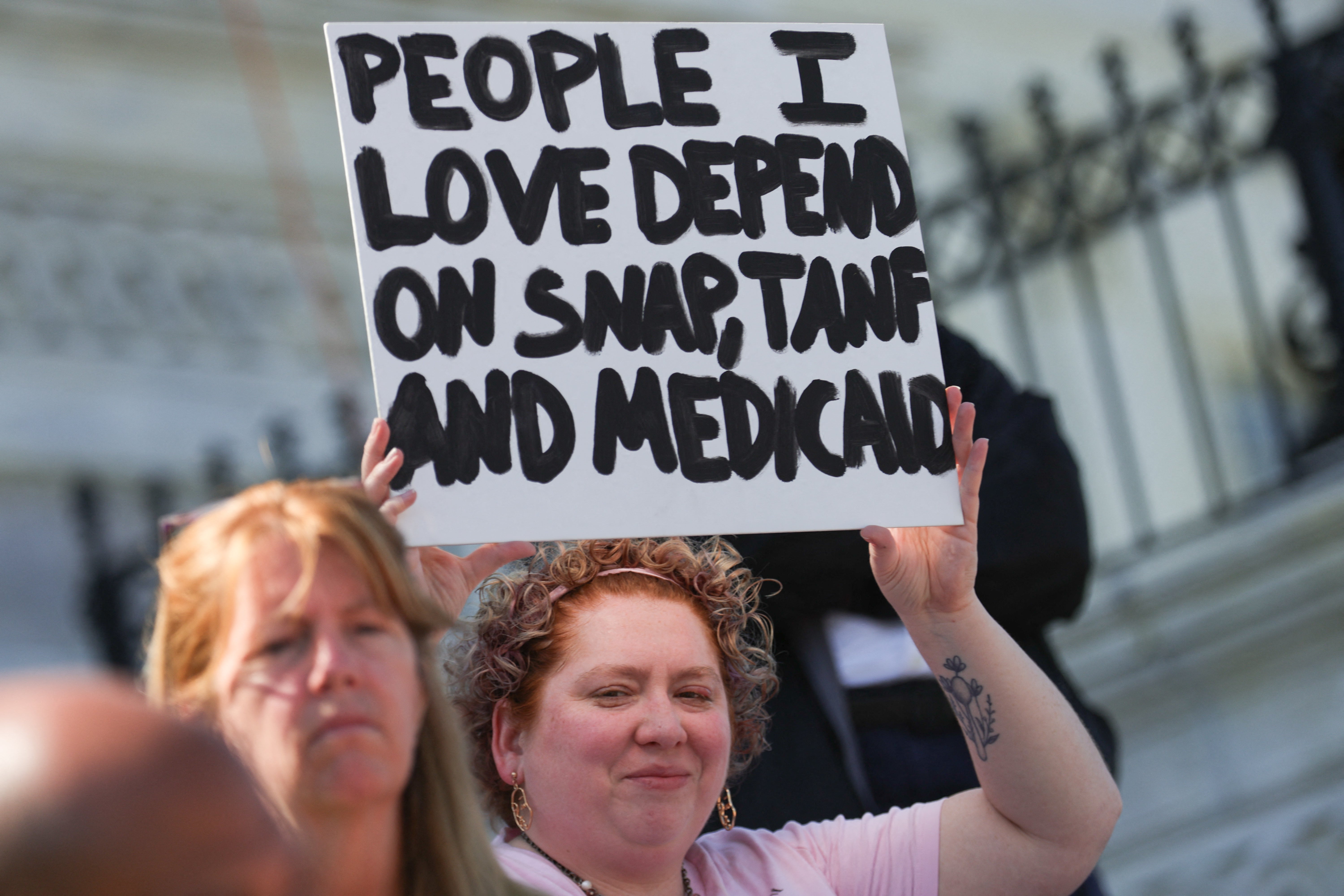

The bill looks to slash taxes and increase spending on oil drilling, the military, and border security, while also making cuts to Medicaid and food assistance programs.

It’s a make-or-break moment for the president and his party, who have invested much of their political capital during the crucial first few months of Trump’s return to the White House on this package. It comes at a time of huge economic uncertainty.

Democratic Leader Hakeem Jeffries said Republicans are trying to “quickly jam this unpopular legislation through the House because they know that the longer they wait, the more will come to light about this cruel and unconscionable bill.”

The bill proposes $1.5 trillion worth of spending cuts to unlock $4.5 billion worth of tax cuts. If Republicans fail to find $2 trillion worth of savings, the amount of money left for tax cuts would be reduced by the difference between $2 trillion and the final number of spending cuts.

The nonpartisan Congressional Budget Office has warned that the package would increase the federal deficit by $3.8 trillion.

If the House Republicans fall in line with the president, the package would next go to the Senate.

Who stands to gain the most from Trump’s spending bill?

Preliminary analysis from the Congressional Budget Office found that the bill would increase benefits for those earning the highest through an extension of the 2017 GOP tax plan.

“The changes would not be evenly distributed among households,” the agency estimates. “In general, resources would decrease for households in the lowest decile (tenth) of the income distribution, whereas resources would increase for households in the highest decile.”

While U.S. households would be aided by smaller tax cuts, the bill is “tilted toward rich Americans,” Martha Gimbel, executive director and co-founder of the Yale Budget Lab, told USA Today.

“It doesn’t really matter if people at the bottom are getting relatively small tax cuts if they're losing their health care, they're losing their SNAP benefits and they're having to pay more money in tariffs,” Gimbel said.

How is Medicaid affected?

More than 70 million Americans on lower incomes rely on Medicaid for almost free health care. The proposed cuts by the House GOP would see a reduction in federal support of nearly $700 billion in the next decade, the Congressional Budget Office said.

The agency estimated that the proposals would reduce the number of people with health care by at least 7.6 million from the Medicaid changes, and possibly more with other changes to the Affordable Care Act.

Trump warned House Republicans not to “f*** around” with Medicaid.

The package proposes a number of changes to qualify for Medicaid. Trump’s bill requires able-bodied adults without children or dependents to work at least 80 hours a month, engage in 80 hours of community service, engage in 80 hours for an educational program or engage in a combination of these three options to qualify. The frequency of eligibility tests is also increased under the bill, which experts warn will kick many Americans off the program through red tape and paperwork issues.

Some people would be exempt from the work requirements including people younger than 19 and older than 64 years of age, pregnant women, foster youth, former foster youth up to the age of 26, people with disabilities, members of Native American tribes or people already in compliance with work requirements for the Temporary Assistance for Needy Families or Supplemental Nutrition Assistance Program.

The bill also includes a provision to reduce Medicaid funding to states that provide health coverage to undocumented migrants by using their own tax revenues. The proposal would mostly impact Blue states.

The White House said the bill “protects Medicaid” by “ending benefits for at least 1.4 million illegal immigrants.”

MAGA bank account

Buried inside Trump’s 1,116-page spending bill is a proposal that would automatically create a tax-advantaged investment account loaded with $1,000 for every American newborn, beginning in 2025 until the end of 2028.

Its name, while a nod to the movement built by Trump, actually stands for Money Account for Growth and Advancement.

But financial advisers warned that Americans have better options when it comes to tax-free savings accounts on offer and the new MAGA account has complex rules.

“It’s like, thank you government for the free money, but I care about the usefulness,” Alan Cole, a senior economist at the Tax Foundation, told Yahoo Finance. “And realistically, this is the sixth or seventh best tax-free savings account option.”

SNAP cuts

Those who receive food stamps through the Agriculture Committee-governed Supplemental Nutritional Assistance Program, known as SNAP, would also face new work requirements under the package.

In particular, the bill increases the age at which able-bodied adults without dependent children must work to receive nutritional benefits from 54 to 64 years old, the year before many seniors become eligible for Social Security and Medicare.

In the same token, it also lowers the age at which children can be considered “dependent” from the age of 18 to younger than seven. That provision would mean that parents of children seven years old and older would fit the definition of able-bodied adults without dependents, and therefore require them to work.

“It may be one of the most egregious items in the entire markup,” Rep. Angie Craig of Minnesota, the ranking Democrat on the Agriculture Committee, told The Independent. “What are you going to do? Just have parents go [to] work and leave their seven-year-old at home? And then, of course, you’re penalizing single parents by having this exclusion for married folks.”

The Congressional Budget Office said that 3 million fewer people each month would have SNAP benefits.

No tax on tips

The legislation includes a measure to create a tax deduction of up to $25,000 for cash tips for eligible employees working in the food, drink and beauty industries.

Passed by the Senate Tuesday, the “No Tax on Tips Act” now moves to the House for a vote. The bill would amend the IRS code, which would allow Americans working in the food, drink and beauty industry to claim a 100 percent tax deduction on tips given in cash, credit, debit cards and checks.

“There shall be taken into account only tips received from customers or clients in connection with the following services,” the bill states. “The providing, delivering, or serving of food or beverages for consumption, if the tipping of employees delivering or serving food or beverages by customers is customary.”

It also sets out that those “providing of beauty services to a customer or client if the tipping of employees providing such services is customary” are eligible.

After 90 days, if the bill is signed into law, the Treasury Secretary will “publish a list of occupations which traditionally and customarily received tips on or before December 31, 2023,” the bill says.

Anyone earning above $160,000 does not qualify for the tax exemption, however.

SALT cap

The State and Local Taxes cap, known as SALT, is a tax break that permits taxpayers to deduct part of what they owe in local and state taxes when filing federal taxes.

Negotiations over the cap, which is currently $10,000, have been partly responsible for the delay in getting Trump’s bill over the line as Republicans bickered.

An agreement was reached Wednesday to raise the cap to $40,000 for a decade for households earning less than $500,000.

For those typically higher-income taxpayers who itemize their deductions, as opposed to taking the standard deduction, the cap is worth thousands of dollars.

With additional reporting from Eric Garcia. The Associated Press contributed

English (US) ·

English (US) ·