ARTICLE AD BOX

A group of wealthy Canadians calling themselves "Patriotic Millionaires" is banding together to lobby governments to increase the amount of taxes they must pay, with a campaign patterned after similar movements in the United States and United Kingdom.

But there is already pushback on the concept — even before the group officially launches in Canada — with the opposing view being that higher taxes would drive entrepreneurship away from this country.

Speaking exclusively to CBC News in advance of the group's Canadian launch, members of the Patriotic Millionaires say their organization is looking for broad changes to wealth taxes and capital gains in this country.

The group says it believes lower-income citizens often pay tax on much of their income, while wealthier investors can leverage dividends, investments and capital gains to change what they pay and how.

"Patriotic Millionaires, which started in the U.S., rapidly realized that this is an international issue," said Claire Trottier, chair of the Canadian branch.

"Every country should be taking a look at the way that they design their tax system to try to ensure greater fairness across the system."

The organization said it's initially focusing on changing how Canadians think about taxing the wealthy, but is working to release research in early June on how it believes different wealth taxes across G7 nations could change government revenues. An event planned for that month in Ottawa will push the idea that as the 2025 host nation for the G7 summit, Canada can encourage other nations to re-assess how wealthier citizens are taxed.

Changing taxation policy by lobbying new members of Parliament and a soon-to-be-announced finance minister is also an explicit goal of the organization, said Patriotic Millionaires Canada executive director Dylan Dussealt.

The organization wants to enable wealthier Canadians to be part of an "organizing, and lobbying campaign to change the public narrative and the law around tax fairness," said Dussealt.

WATCH | Who was telling the truth about the capital gains tax?: Who’s telling the truth about the capital gains tax? | About That

Even Trump might support higher wealth taxes

Further south, U.S. President Donald Trump has recently said he was "OK" with raising taxes on the wealthiest Americans in order to benefit people in middle- and lower-income brackets.

"I would love to do it, frankly," he said in the Oval Office on Friday. He says he would be willing to pay more in taxes himself.

However, the U.S. House of Representatives Speaker Mike Johnson and other top Republicans have resisted the idea of raising taxes on the wealthy.

The president told Johnson this past week that he wanted to see a higher tax rate on incomes of $2.5 million for single filers, or $5 million for couples, only to sort of back off the idea on Friday. "Republicans should probably not do it, but I'm OK if they do," Trump wrote on social media.

But Trump's verbal — if loose — support of increasing tax on the rich didn't actually surprise Patriotic Millionaires Canada.

"[Trump] and his rich friends don't pay income tax because they don't declare income. It's just one more sign of the problems with the tax system in the U.S. that are mirrored in Canada," said Dusseault.

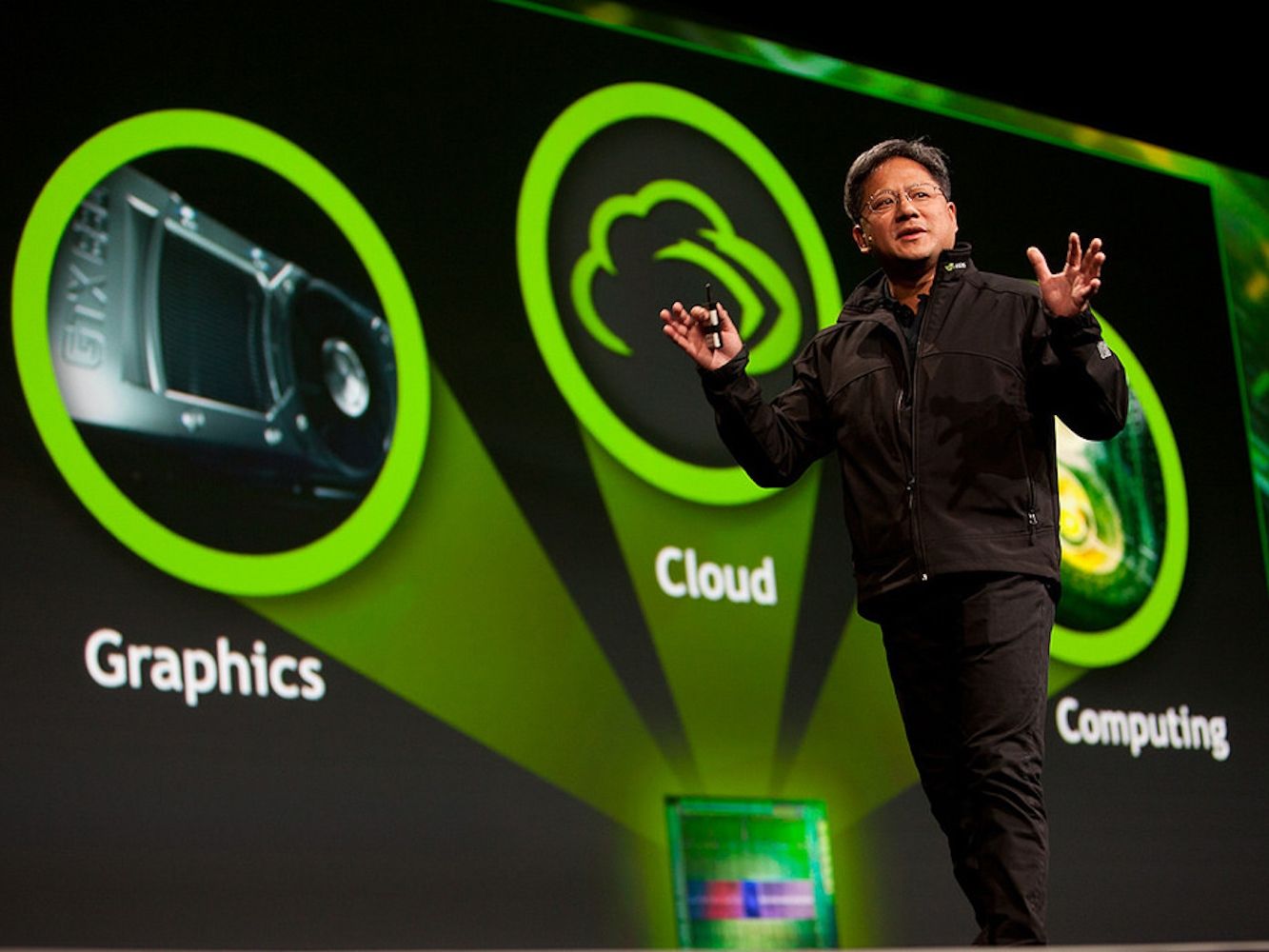

Meanwhile, group member Avi Bryant, who now lives on B.C.'s Galiano Island, founded a Canadian tech company that was sold to Twitter in 2010 and says the bulk of his family's wealth comes from that work in the Silicon Valley tech sector. He says he believes higher taxes for the wealthy can maintain Canada as a desirable location to both live and work.

"If we want thriving businesses with knowledge work, like tech startups, [we need] to be a nice place to live. Taxation and redistribution and good social services help a great deal with that," said Bryant.

New government to lobby

The recently victorious federal Liberal Party's platform includes tax changes focused on increasing tax penalties and fines through the Canada Revenue Agency (CRA), promising revenues of $3.8 billion over four years.

It also promised a tax cut to the lowest marginal tax rate, which could be interpreted as a tax cut for many — if not all — Canadians earning income.

Only the NDP, who were not able to retain official party status in the election, promised a tax increase on what that part labelled the "super rich."

"Why is it that we're paying less taxes than the people who are actually working for a paycheck... your teachers, your nurses," said Patriotic Millionaires group member Sabina Vohra-Miller, who splits time between California and Toronto with her spouse Craig Miller, former chief product officer at Shopify.

Specifically, one goal of the organization as it launches will be to encourage the federal government to re-attempt a functional increase in how much wealthier Canadians would pay in capital gains tax.

That policy announcement triggered opposition when first announced earlier in 2024. The finance minister at the time, Chrystia Freeland, said it was intended to address what she called issues of tax fairness.

Groups such as the Calgary Chamber of Commerce had said the changes to capital gains, which would primarily have hit wealthier Canadians, were a "negative signal for investment."

In the end, the capital gains changes were implemented, then delayed by the Liberals under Justin Trudeau. They were then fully cancelled by Prime Minister Mark Carney. Conservatives were also against the tax increase.

Anti-tax anxiety in current climate

The principle of increasing taxes that primarily target the wealthy elicited a fiery reaction from a venture capitalist in Canada.

"If you want to use tax policy, you tax the things that you don't want," said John Ruffolo, the founder of Maverix Private Equity and vice-chair of the Council of Canadian Innovators, a group that referred to the now-cancelled capital gains tax changes as "bad policy."

"You don't want wealthy people, you don't want capital, you don't want entrepreneurship. Is that what we're saying? Is that what you really want?" said Ruffolo.

"If the answer is, well, of course not? Well, that's what will happen," he said.

A Canadian expert in taxation points out that weaker economic indicators in Canada, along with anxiety around relations with the U.S., could mean that politicians will be very cautious to respond to lobbying efforts to increase taxes.

"I think there's anxiety about doing anything that might signal anything that would cause people with money to think, Oh, well, Canada is not a good place," said David Duff, director of the Tax LLM (Master of Laws) program at the Peter A. Allard School of Law at the University of British Columbia.

"We're also in an environment where a sort of an anti-tax agenda has become politically more dominant," he said, an observation in keeping with both major Canadian federal parties explicitly indicating they would not support the previous increase in capital gains inclusion rates.

Duff pointed out that increasing taxes on the wealthy may not generate earth-shattering revenue for Canadian governments, but can be a symbolic statement.

"In many cases, these are people who have benefited from a Canadian society and economy that's allowed them to earn or inherit significant fortunes.

"The downside, in my experience over 30 years of doing tax, is generally highly overblown ... dire economic consequences from any kind of additional taxes," he said.

Duff also pointed out that while higher taxes may lead Canadians to try and hide their taxes through loopholes, if that was easily done, those subject to higher levies "wouldn't get so upset about raising taxes."

Donations aren't good enough: millionaire

The idea that donations and philanthropy are an alternative to mandatory wealth taxes is mentioned by both proponents and opponents of the lobby group.

"It's just not enough to wait for people to make the proactive decision to give away their money and also trust that they're going to give away their money to these different priorities," said Trottier, who is involved with multiple philanthropic organizations including a family foundation that pledges hundreds of millions of dollars.

On the flip side, opponents say they should not be forced — through taxation — to fund those priorities, especially if they must give up control over how the money is used to governments.

"If you feel so passionately about it, nothing stops you from giving it all the way, nothing," said Ruffolo, who said he fundamentally believes in giving his money away.

"But I will decide I will decide who gets it and why," he added, pointing out that Warren Buffett is planning to do the same with his fortune.

The philanthropist and billionaire Buffett, 94, has announced he will retire at the end of this year and had previously said on his death he'll donate 99.5 per cent of his remaining wealth to a charitable trust.

Tech billionaire Bill Gates has made a similar pledge, saying he will donate 99 per cent of his remaining tech fortune to the Gates Foundation, worth an estimated $107 billion US.

Both Buffet and Gates have also argued that the rich should pay higher taxes.

However, Patriotic Millionaires chair Trottier feels there is a stronger issue at play: that taxation must be used to address the growing gap between the rich and poor in Canada, rather than through select causes supported by choice.

The gap between the disposable income of the wealthiest and poorest groups of Canadians hit the widest gap in 2024 since Statistics Canada first starting collecting data in 1999.

The widening gap was pinned, at the time, on investment gains — something Patriotic Millionaires Canada wants to see taxed differently in this country

"Are we going to recognize that massive growing runaway wealth inequality is a danger to democracy?" Trottier said.

20 hours ago

3

20 hours ago

3

English (US) ·

English (US) ·